can i withdraw from my 457 without penalty

A 457 plan is a type of tax deferred retirement plan and is similar to a 401k or 403b plan. If you leave your job you can withdraw money without penalty after you reach the age of 25.

How A 457 Plan Can Boost Your Retirement Savings Calpers Perspective

Unlike other retirement plans participants can withdraw funds before the age of.

. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. In general you will be subject to a 10. 529 plan account owners can withdraw any amount from their 529 plan but only qualified distributions will be tax-free.

There are a few exceptions to the age 59½ minimum. Unlike other retirement plans under this IRC 457 members can withdraw money until age 595 if you end up with an employer or have. What are the 2 exceptions to withdrawing funds from a 401 K early without a penalty.

When Can You Withdraw From 457 Without Penalty. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. From my understanding please correct me if Im wrong.

You can withdraw the contributions at any age penalty-free. Ad Fidelity Is Here To Help. You can contribute an additional 6000.

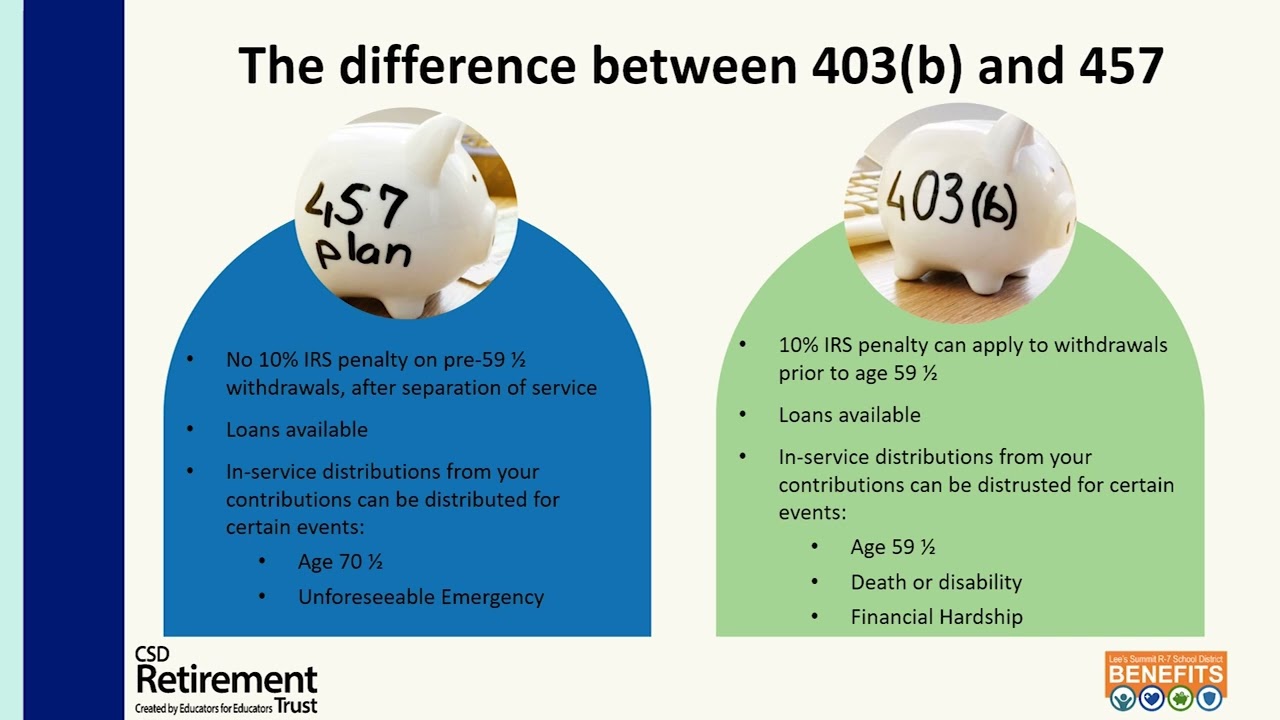

I can buysell any stocks not limited to mutual funds. You can take penalty-free withdrawals from both retirement plans after 59 ½ but you will still pay income taxes on the. Once you retire withdrawal rules for 457b and 403b are similar.

Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half years old. You can withdraw money at any age without penalty through your 457 plan although you currently have to pay taxes on most of the money you withdraw.

You can access your funds at age 59½ without paying an early-withdrawal penalty if youve retired and you ended your employment after you reached age 55. Basically Im able to manage my own roth 457 account through Schwab ie. The earnings portion of any non-qualified distributions.

Usually once youve attained 59 ½ you can start withdrawing money from your 401 k without paying a 10 penalty tax for early withdrawals. When can I withdraw from my 457 B without penalty. The IRS dictates you can withdraw funds from your 401k account without penalty only after you reach age 59½ become permanently disabled or are otherwise unable to.

A 457 plan is a type of tax deferred retirement plan and is similar to a 401 k or 403 b plan. The IRS offers penalty-free withdrawals under.

403 B 457 Retirement Plans Lsr7 Benefits

457 B Vs 401 K Plans What S The Difference Smartasset

16 Ways To Withdraw Money From Your 401k Without Penalty

How 403 B And 457 Plans Work Together David Waldrop Cfp

In Service Distributions From Gov T 457 B Plans Retirement Learning Center

Understanding 457 B Vs 403 B Retirement Plans Ticker Tape

Everything You Need To Know About 457 Plans Deferred Compensation

Everything You Need To Know About 457 Plans Deferred Compensation

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

Is The Tsp A 457 Plan Government Worker Fi

457 B Retirement Plans Here S How They Work Bankrate

457 Deferred Compensation Plan White Coat Investor

401 K Early Withdrawal Overview Penalties Fees

What Is A 457 B Plan How Does It Work Wealthkeel

457 Vs Roth Ira What You Should Know 2022

How 403 B And 457 Plans Work Together David Waldrop Cfp